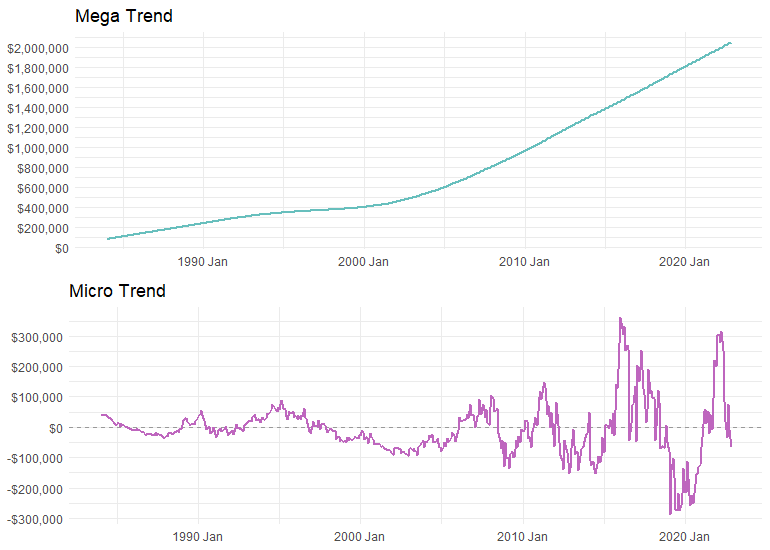

Let’s start by differentiating between a trend (Mega Trend) and statistical noise (Micro Trend).

The media has a heyday with the Micro Trends because they lend to sexy headlines.

SALES ARE DOWN X% FROM LAST MONTH (or year over year).

Often this is simply a repetitive seasonal pattern. For example, sales always trend higher in the summer than in the winter, and sales almost always drop from November to December.

It’s simply a reference of a point in time and not really insightful material.

Have a look at the two charts below. The lower one looks like my heart rate after a cup of coffee, and the other a nice smooth and steady incline like a hike on a sunny day.

When we zoom in on my heart rate we realize there’s nothing wrong, it’s just a morning cup of coffee - it’s typical and somewhat expected, therefore, statistical noise.

When I take my caffeine high and go for a hike the heart rate smooths out and I’m able to make a slow and steady ascent.

Although these charts look drastically different, they are both built from the exact same data series - 30 years of market activity.

If you’re still with me then let’s break it down. Not as in a dance break, although take one if you need it, but as in let’s summarize how Mega Trends and Micro Trends drive the housing market.

Mega Trends are driven by slow moving, but impactful factors such as population growth and demographic change.

Micro Trends are driven by factors such as seasonal changes, interest rates, adjustment to government policy or recessions.

So we want to look past the headlines and set our sights on the longer term dynamics of the market (the Mega Trends).

To take a Mega Trend off of its trajectory, major events must take place. Like a devastating natural disaster or a zombie apocalypse. Anything is possible, but if it comes down to either of these events we’re not really gonna care too much about the state of the housing market.

If you want to get an idea of where the market will be in the next 5 - 10 years then look to the Mega Trends. If you’re more interested in where the market will be at in the next few months, then look to the Micro Trends, but be careful not to confuse short run cyclical factors with seasonal patterns.

Recent data from Zonda (formerly Urban Analytics) showed that Metro Vancouver’s population will increase by 40,719 persons in 2023 (mostly due to record levels of immigration and migration from other provinces), while the number of new strata housing starts will be just 13,667 units and this gap will widen in 2024. Over the next three years, in fact, we will see a shortage of more than 27,000 rental and strata homes needed to keep pace with population growth.

Now with reduced purchasing power thanks to increased interest rates first-time home buyer/occupiers will be competing for units with investors as former rental restricted units (more on that below) now become open for all.

Bottom line, now is an excellent time to be a home buyer!

Want a Complimentary Home Evaluation

or Market Advice?